GP Tip: Find Amounts in GP with GL Transaction SmartList

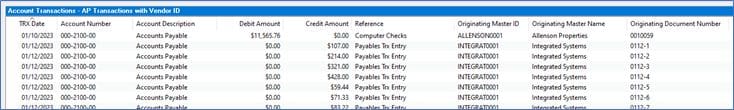

Here is an easy way to find everywhere that a particular dollar amount posted in GP. Maybe an aging report doesn’t tie out to the corresponding GL account. If you’re lucky, the amount of the difference could be one transaction. Look for that amount with another Financial Accounts Transactions SmartList.

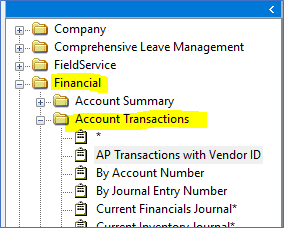

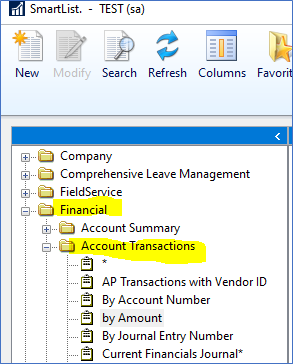

Open SmartList and expand the Financial folder then the Account Transactions folder.

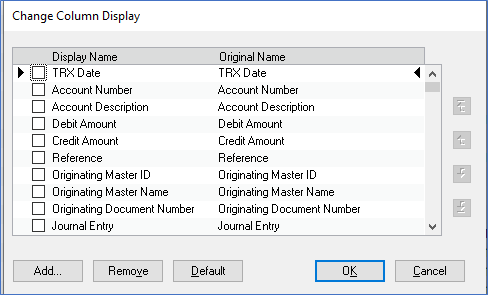

Start with an existing list that contains the columns you want displayed in this new list.

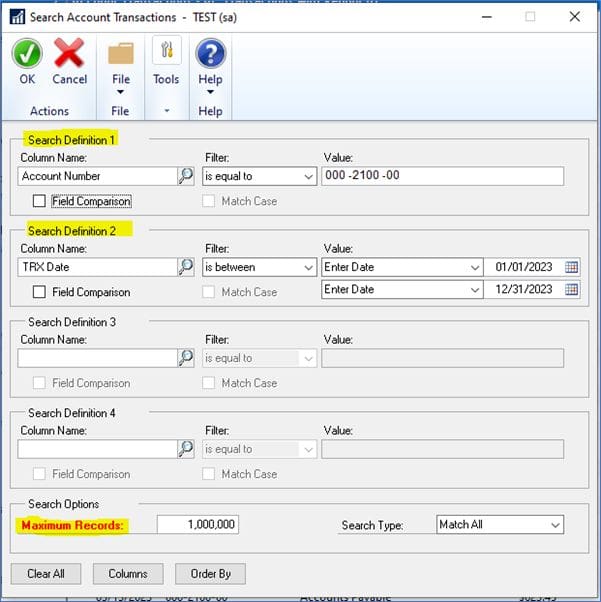

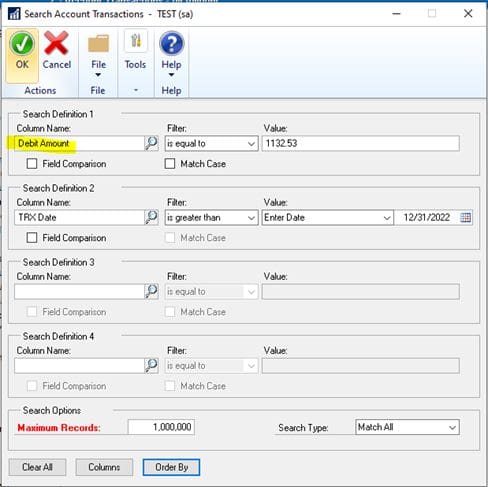

Click on the Search button. Filter on Debit Amount or Credit Amount. Add a Date Range filter, if needed. If you first searched on Debit Amount and didn’t get any results, try searching on Credit Amount next.

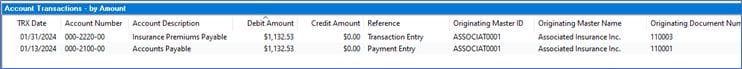

Click on OK to view results.

Remember, you can always double-click on a row to drill-down to the transactions.

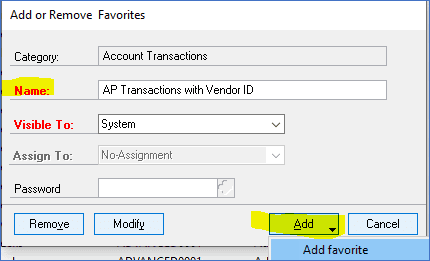

Click on Favorites to save the new list with a new name.

Need GP Support?

If you need Dynamics GP support, or if you are ready to upgrade GP, we can help! Contact CSSI for help with GP.