GP Tip – Federal Payroll Tax Table Update Instructions for GP

Wondering how to update the federal payroll tax table in Dynamics GP? Here is a helpful explainer:

1) Ask all users log out of GP

2) Log into GP as the ‘sa’ user

3) Go to Microsoft Dynamics GP > Maintenance > U.S. Payroll Updates > Check for Tax Updates

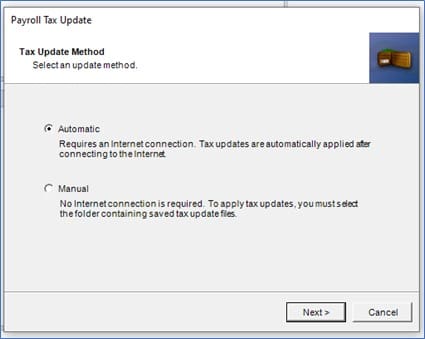

4) Select the Automatic method then click Next

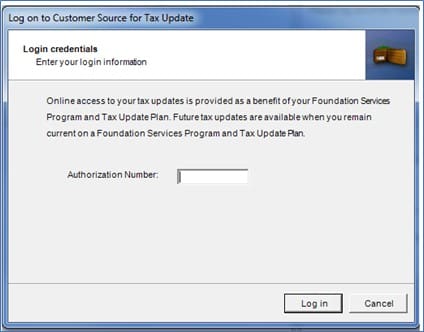

5) Enter your Authorization Number. This is your Authorized number with CustomerSource, which is normally your phone number (with the area code and no punctuation). Click on Login.

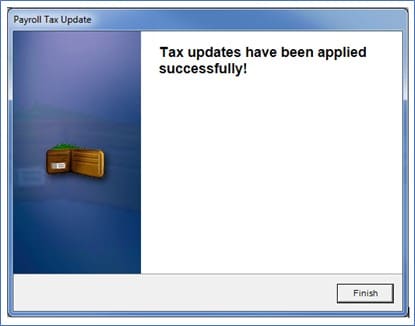

6) The tax tables will update. Click on Finish after the updates have been applied successfully.

7) You can verify that you have the latest tax update by going to Microsoft Dynamics GP > Tools > Setup > System > Payroll Tax. The “Last Tax Update” field should have the date of 1/19/18.

8) This updates Federal and State withholding taxes only

9) If you have a change to your state unemployment tax rate, go to HR & Payroll > Setup > Payroll > Unemployment Tax. Select the State and change the Tax Rate.

Contact CSSI For GP Help

Do you have questions, or do you need more GP support? Contact the team at CSSI for GP help.